social security tax limit 2022

As of January 1 2022 the Social Security full FICA wage base will increase to 147000. If your combined income was more than 34000 you will pay.

All The States That Don T Tax Social Security Gobankingrates

The tax rates.

. 2 days agoDuring those 35 years they earned past the Social Security tax wage cap. It was 137700 in 2020 and 106800 in 2010. IRS Tax Tip 2022-22 February 9 2022 A new tax season has arrived.

The Social Security wage base is 147000. For 2022 an employee will pay. 1 2022 the maximum earnings subject to the Social Security payroll tax will increase by 4200 to 147000 up from the.

Employers then match any Social Security taxes. There is no limit on the amount of earnings subject to Medicare hospital insurance tax. Social Security recipients will get a 59 raise for 2022 compared with the 13 hike that beneficiaries received in 2021.

The exception to this dollar limit is in the calendar year that you will reach full retirement age. Only the social security tax has a wage base limit. 10 Reasons You Should Claim Social Security Early Find.

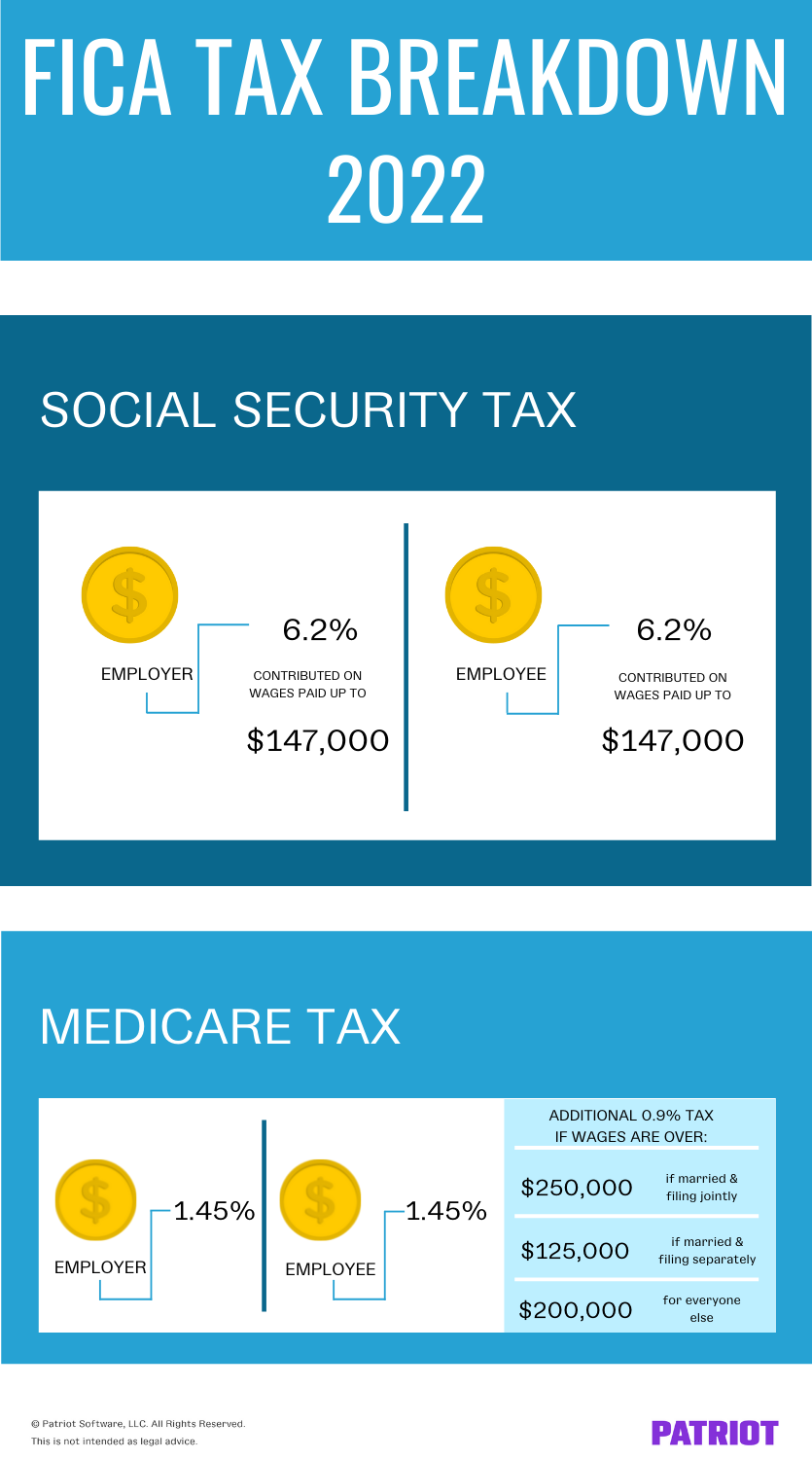

However the exact amount changes each year and has increased over time. In 2022 the Social Security tax rate is 62 for employers and employees unchanged from 2021. For 2022 the FICA tax rate for employers is 765 62 for Social Security and 145 for Medicare the same as in 2021.

That means a bigger tax bill. This could result in a. The 765 tax rate is the combined rate for Social Security and Medicare.

For 2022 that amount is 147000. This is 260 higher than the 2021 max of 8854. 20 Best Places To Live on Only a Social Security Check.

For 2022 the Social Security earnings limit is 19560. However just because Social Security benefits are taxed differently than IRAs doesnt mean you can collect Social Security benefits tax-free. For earnings in 2022 this base is 147000.

2364 for someone who files at 62. The employer and employee tax rates will remain the same in 2022. We call this annual limit the contribution and benefit base.

The Medicare wage base will not have a dollar limit for 2022. The wage base limit is the maximum wage thats subject to the tax for that year. However the 4200 rise for 2022 is.

Back in 2000 the taxable maximum was just 76200. The OASDI tax rate for wages paid in 2022 is set by statute at 62 percent for employees and employers each. In 2022 the Medicare tax rate for employers and employees is 145 of all wages unchanged.

The maximum wage taxable by Social Security is 147000 in 2022. The most an individual who files a claim for Social Security retirement benefits in 2022 can receive per month is. From there youll have 1 in Social Security withheld for every 2 you earn.

Also as of January 2013 individuals with earned income of more than in Medicare taxes. These benefits are taxed using a formula developed by Congress in the 1980s and. Or Publication 51 for agricultural employers.

The Social Security tax rate remains at 62 percent. The tax rate for 2022 earnings sits at 62 each for employees and employers. For every 2 you exceed that limit 1 will be withheld in benefits.

In 2022 the Social Security tax limit increased significantly to 147000. This means high earning people will not have to pay taxes past a certain point in their income. For earnings in 2022 this base is 147000.

Thus an individual with wages equal to or larger than 147000. Finally these individuals were able to delay collecting their Social Security benefits until they turned age 70. The Social Security full FICA rate remains at 765 620 Social Security plus 145 Medicare for wages up to 147000.

The resulting maximum Social Security tax for 2022 is 911400. Working that amount of time may not be impossible but earning 6 figures each year might be. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits.

For 2022 the maximum wage base jumps to 147000 an increase of 4200 or 29 over the max of 142800 that was in place for 2021. Filing single head of household or qualifying widow or widower with 25000 to 34000 income. There is a maximum amount out of a persons pay that can be taxed by Social Security.

Workers who earn 60000 per year pay payroll taxes on all of their income because the wage base limit on Social Security taxes is almost twice that amount. Below are federal payroll tax rates and benefits contribution limits for 2022. For those who are self-employed the OASDI tax rate is 124.

Theres a maximum amount of compensation subject to the Social Security tax but no maximum for Medicare tax. The new Social Security tax limit in 2022. Refer to Whats New in Publication 15 for the current wage limit for social security wages.

The maximum amount of earnings subject to Social Security tax will rise 29 to 147000 from 142800 in 2021. Fifty percent of a taxpayers benefits may be taxable if they are. The Medicare portion HI is 145 on all earnings.

For the period between January 1 and the month you attain full retirement age the income limit increases to 51960. At a rate of 62 the maximum Social Security taxes that your employer will withhold from your salary is 9114. The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see below.

For 2022 the maximum limit on earnings for withholding of Social Security old-age survivors and disability insurance tax is 14700000. In 2022 that limit is. For 2022 the self-employment tax imposed on self-employed.

Wage Base Limits. This amount is also commonly referred to as the taxable maximum. So individuals earning 147000 or more in 2022 would contribute 9114 to the OASDI program and their employer would contribute the same amount according to the Social Security Administration.

Withheld benefits wont be. The rise in the social security payroll tax threshold from 127200 in 2017 to 147000 in 2022 indicates a 156 percent increase over the last five years. In recent years you need to earn a six-figure salary to get a top Social Security payment.

In 2022 you can earn up to 19560 a year without it impacting your benefits. Social Security tax is paid as a percentage of net earnings and has an annual limit. If that total is more than 32000 then part of their Social Security may be taxable.

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Why Are Social Security Benefits Taxable The Motley Fool

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

The Social Security Wage Base Is Increasing In 2022 Sensiba San Filippo

Social Security Tax Limit For 2022 Explained Fingerlakes1 Com

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Do You Have To Pay Tax On Your Social Security Benefits Youtube

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

Full Retirement Age For Getting Social Security The Motley Fool

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Social Security And Medicare Benefit Changes For 2022 And Beyond

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Social Security Wage Base Increases To 142 800 For 2021

What Is The Social Security Tax Limit Social Security Us News